CoreVest Finance recently attended the MBA CREF/Multifamily Housing Convention & Expo in San Diego, CA.…

Back to Basics, Finance is All About Trust

by Tuan Pham, SVP, Marketing

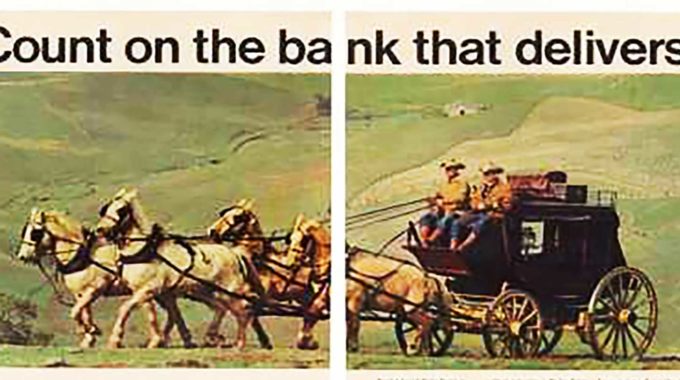

When a magnitude 7.8 earthquake struck San Francisco in 1906, the president of Wells Fargo Bank quickly telegraphed, “Building Destroyed, Vault Intact, Credit Unaffected.” His timely response and strategic choice of words underscored the importance of trust within finance.

The power of trust

Indeed, trust is so powerful that it can make or break whole economies. Our most prosperous times rode on the confidence of its people. Money, gold and treasured possessions were once entrusted to couriers on horseback with very little background check or tracking systems available. Yet, we continued to trust, and we continued to grow. When our trust deteriorated, however, so too did our economy. The financial crisis of 2007-2008 was a crisis of trust, or more aptly – mistrust.

Trust and the economic climate

According to Susan Milazzo, Executive Director of the California Mortgage Bankers Association, membership has been greatly affected by the changing economic climate within the past two decades. However, she has also seen some of CMBA’s most stalwart members remain steady at the helm despite the shifting tides. Her experience echoes the words by a former CEO who once shared with me, “Companies may come and go, but the most trusted ones will stick around. They are the ones who will define the industry.”

Trust is the true valuation

Although there are countless numbers and data tapes involved, real estate finance is ultimately a business of relationships, and those relationships are forged through trust. Money and property may be part of the equation, but the true measurement, the true valuation comes in the form of trust. How much does a lender trust in the borrower to manage its money in a justifiable and sustainable way? How much does a borrower trust in the lender to deliver as promised and avoid jeopardizing the project with delays, unprofessionalism, disorganization, or eventual re-trades?

Real estate finance is ultimately a business of relationships, and those relationships are forged through trust

Data vs. trust

Some believe that the answer lies in technology and data, and that data should be the driver for all things. While data is important in the valuation of trust, there are many dangers in allowing data to override trust. First, data can be wrong. Every data system ever built, from computers to rocket ships, have had serious errors and flaws. Data can also mislead. Two different reads of the same data may provide very different perspectives, depending on the values being considered. Data, simply, cannot replace trust. Should a company hire applicants based solely on data from their resumes and test scores? Should a user trust every match provided by a dating site or every recommended pick from a sports-betting site? Data should help inform our decisions, not make them for us.

Greed vs. trust

Brands that are built upon the foundation of trust have endured many cycles, through wars and recessions, while their counterparts have often stumbled. A common downfall among these failing companies is greed over trust – allowing the lure of financial gain to undermine trust. Financial companies have a fiduciary duty to uphold, both upstream and downstream. A trusted company understands this, acts with integrity, performs due diligence, takes the appropriate measures, and knows when to turn down transactions that do not meet its guidelines. Less conscientious companies often take shortcuts, construct empty shells, and aggressively sell them to susceptible audiences for quick gain – only for everything to crumble thereafter. We have seen this happen time and time again. Hyper growth versus measured growth, over-promise, under-delivery, unreasonably low rates, and a shotgun style of sales and marketing that stretches the limits of truth and decorum are signs of a company selling empty shells.

Brands that are built upon the foundation of trust have endured many cycles, while their counterparts have often stumbled

How can trust grow?

An interesting example of trust development happens regularly in professional sports. Talented college players are often drafted and paid large sums of money to just sit and watch their first few professional games. Their goals are to evaluate and learn from more seasoned players and balance their raw skill set with experience and intuition in processing information. They learn to better read offenses and defenses, and avoid lunging at the very first opportunity or letting the very last one pass by. They also repeat routes and scenarios over and over again with the purpose of mastering them. This improves their execution, and in turn, helps them earn the trust of their coaches and team.

In finance, trust is centered around a similar pattern of evaluation, execution and repetition. Raw data is met with experience and intuition. Execution is fine tuned and repeated to the point of consistency and reliability. As the cycle grows, the “trust index” grows.

Build trust and the rest will follow

Companies can benefit from investing their resources in developing a culture of trust. Place trust at the forefront of all decisions. Hire trustworthy team members and help them grow. Continue to cultivate the importance of trust, both internally and externally, and communicate it often. In the end, trust will pay dividends. By addressing the concerns of clients and ensuring their trust in 1906, Wells Fargo has since grown leaps and bounds, elevating from a local bank to a national Fortune 100 corporation. A similarly bright future awaits companies founded upon trust.

CoreVest is a leading provider of financing solutions to residential real estate investors. We provide attractive long-term debt products for stabilized rental portfolios as well as credit lines for new acquisitions. For more information about how CoreVest can help grow your rental and rehab business, please call 844.223.2231 or submit our contact form.