CoreVest Finance recently attended the MBA CREF/Multifamily Housing Convention & Expo in San Diego, CA.…

2018 Outlook: Hot Markets for Residential Real Estate Investors

By John Prins, Relationship Manager

Each year, residential real estate investors across the United States speculate about what will be ‘America’s Next Top Market’ (has quite the HGTV-worthy ring to it, huh?). In the months that follow, investors, financiers, and the stakeholders alike watch as these speculations meet, exceed or fall short of the previous year’s expectations. This year, we tried to understand the madness that is an outlook at the 2018 housing market, dug through the research provide by our constituents as well as that from our own experiences—and this is what we came up with.

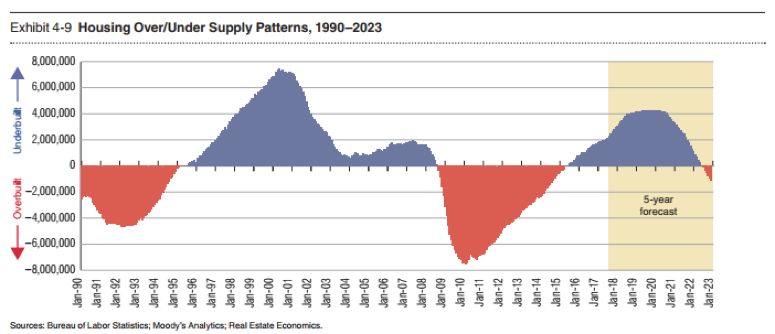

All 3 groups we will look at aim to capitalize on the diminishing housing supply which will drive up prices and force potential homebuyers to remain renters for longer.

Before we dive in, it’s important that we clearly identify who we’re talking about—and what they’re looking for:

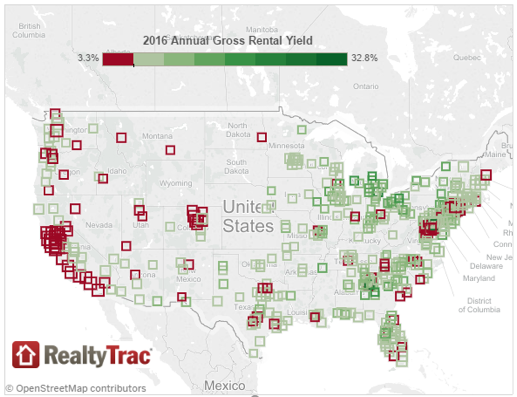

- Rental Investors/Landlords – The landlord investors are those seeking high yielding investments, derived from strong rental income relative to home prices—they’re seeking densely populated markets that have endured rental growth with the proportional home price appreciation – keeping mortgages low and rents high. Beyond average rental numbers, they look to general demographics like population and median household income, as well as occupancy rates to derive what they perceive to be demand generators.This group isn’t averse to buying in bulk—and typically operates in geographically concentrated markets to keep operations centralized.

- Flippers – The not-quite-as-seen-on-TV fix and flip investors are those targeting distressed assets with tremendous upside. They’re looking for a great deal combined with a market where home values are moving in the right direction (up). Flippers seek high-quality, cost-effective local contractors to complete their rehab projects—and fast. Cost-effective and cheap labor help these investors to diminish carrying costs and expedite the movement of their inventory.Once the project is completed, the opportunity cost of missing what they perceive as another great deal is enough to make these investors highly motivated to sell—and quickly—so they’re looking for markets that move. Market’s with low average days on market (DOM) metrics will likely appeal to them and meet their needs

- Opportunists – Opportunists are those investors that prefer flexibility in their business ventures, and can be the hybrid-investor from the two groups above. They buy speculatively, never restricting themselves to one specific residential asset type. This group could find anything from SFR’s, condo units—even apartment buildings in their pipeline for the year at the right price.This group’s opportunistic tendencies don’t stop on the buy side—rather, once projects have been completed, they seek best possible outcomes as well. Do they flip and capture the appreciation value, or do they rent out and let the asset(s) cash flow for them? The strategy employed will likely vary project to project, and always keep those speculating about the end-game guessing.

The following lists highlight the top two markets for the rental investor, flipper and opportunist, in that order, and based on their unique interests and investment/exit strategies.

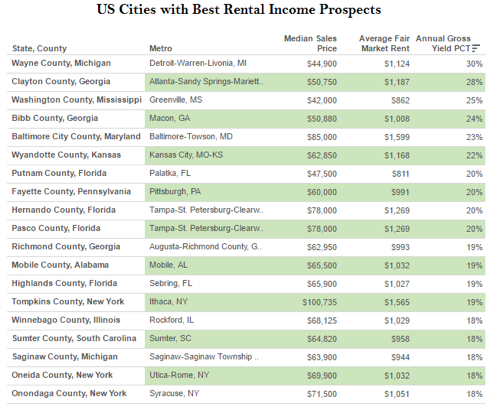

Steady Wins the Race. Primed Markets for Rental Investors:

Key Metrics: Gross Yield Percentage, Price-to-Rent Ratio,

- Detroit, MI

Detroit, Michigan earns the top spot on our list of the best cities for rental investors. Home listing prices still haven’t recovered fully to pre-recession levels but rents have managed to come back nicely, offering high cash-flowing assets at low upfront costs. Despite average home prices increasing 27% year over year, Forbes recently declared Detroit to still be the most undervalued housing market in the nation.

People won’t continue overlooking this market forever. With 3.0% in delinquent mortgages, compared to the national average of 1.6%, there’s still plenty of opportunity to source properties below market value.

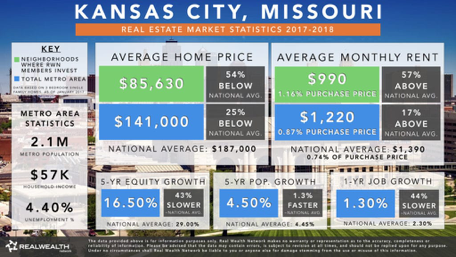

- Kansas City, MO

Kansas City is one of the few markets that still boasts low median sales prices while also still being able to drive solid rents. While short term job growth may not be exactly where investors desire, the median household income experienced a year over year growth of 6.16%, which should help drive spending power.

In addition, the population growth and tax incentives the city provides are attracting quality employers, which should lead to home price appreciation down the line.

Some Like it Hot. Markets for Fix and Flip Investors with Fiery Returns:

Key Metrics for 2018: YOY Home Price Change, Median Home Value, Avg. Days-to-Flip

- Baltimore, MD

Baltimore, MD found its way to the #1 spot on Time’s list of top market’s for house flipping for 2018, so it seemed appropriate to include it on ours as well. During the 2017 calendar year, house flippers in the Baltimore market saw an impressive 96.6% average ROI on their flip-focused investments, as well as a +2.4% bump on YOY average home values.

Couple that with the market’s estimated average days-to-flip of just over 6 months—and you have a market that looks to be red hot for flippers with tremendous upside for those looking to jump in on the action.

- Memphis, TN

Memphis has been an extremely interesting market for fix-and-flip investors because of the extremely low days-to-flip (DTF) metric. With only 4 months needed to complete the average rehab and close the sale, as well as vacancies lowering to nearly 10%, the Memphis housing market should be primed for a boost.

Many people are considering Memphis to be one of the prime “sellers’” markets this year because of the lack of new construction in the area to meet demand. Without development, fix-and flip investors should be able to capitalize on buyer demand in the flourishing Memphis MSA.

Ready to Seize the Moment? Markets That Can Swing Either Way for Opportunists:

Key Metrics for 2018: All of the above

- Oklahoma City, OK

Supply for Single Family housing in Oklahoma City remains down with less than a 4-month supply of existing inventory, decreasing over 3% year over year. The upscale market is moving the slowest, with the home price appreciation happening most noticeably in the $200,000 and less market, which is where many investors find value propositions. The short supply results in more competing bids, which have driven listing prices up 5% year over year, and forcing more families to rent for longer. When forecasting for real estate opportunities for 2018, look no further than Oklahoma City as potential value play.

- Jacksonville, FL

Jacksonville has experienced tremendous change in the past decade, with a metropolitan area of more than 1.3 million residents, growing twice as fast as the national average. Jacksonville has bright prospects in terms of economic growth as well, with job growth expected to be almost 40% in 10 years as well as four Fortune 500 companies based in the city. The typical $100,000 home in Jacksonville rents for 20% higher than the national average, which tells us there is plenty of opportunity for investors in the short term and long term with home price appreciation down the line.

Summary

Regardless of what metrics and other assessments of a markets relative value, 2018 projects to be another positive year for the residential real estate investment community. Whether you’re a rental investor (landlord), flipper, or simply a speculative opportunist—it would be wise to start preparing for the opportunities that will come during the new year—and if so, we here at CoreVest would love to be your partners through the experience.

Now is the time. Looking to explore your financing options? CoreVest is a leading provider of financing solutions to residential real estate investors. We provide attractive long-term debt products for stabilized rental portfolios as well as credit lines for new acquisitions.

For more information about how CoreVest can help grow your rental and rehab business, please call John Prins at 212.230.3341 or email [email protected].

References

- https://www.pwc.com/us/en/asset-management/real-estate/assets/pwc-emerging-trends-in-real-estate-2018.pdf

- http://gordcollins.com/real-estate/best-us-cities-to-buy-rental-income-properties-2017-to-2020/

- http://time.com/money/4784913/house-flipping-best-25-cities/

- https://www.realtor.com/news/trends/top-housing-markets-of-2018/

- https://www.realwealthnetwork.com/markets/jacksonville-florida/

#IG