Leading Lender to

Residential Real Estate Investors

CoreVest prides itself on flexibility and reliability. We find ways to get deals done and help our clients grow their businesses.

Grow with CoreVest

Partner with us and take your business to the next level

Direct Access to Capital

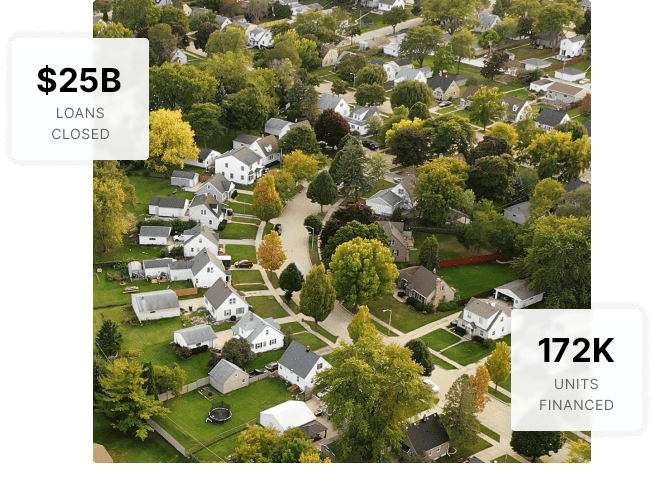

We’ve closed over $25 billion in loans, offering borrowers uncapped access to capital.

Customized Loan Products

We’ve worked with thousands of investors, tailoring our loans to their unique needs.

True Nationwide Lending

We’ve closed loans in 46 states, financing more than 172,000 units across the nation.

One-Stop Shop for Investment Loans

CoreVest offers convenient financing options throughout the investment lifecycle.