Millennials And Their Impact On The Real Estate Industry

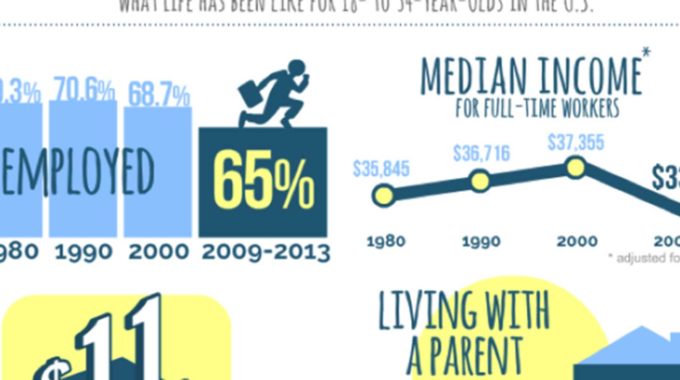

The 92 million Millennials born between the years of 1980 – 2000 make up the largest generation in U.S. history. They dwarf even the Baby Boomer generation at 77 million. The Millennials are known as the sharing generation and have put off making major life decisions, such as buying a car or home, getting married and having children, longer than any previous generation. A significant factor driving this trend is the economic times they have experienced in their adulthood, including a tighter credit market, lower employment levels, smaller incomes and greater student loan debt, which leaves less disposable income.

It is not only Millennials that have experienced a reset of the norm. Parents of Millennials have also had less disposable income to share with their adult children. It is no wonder Millennials have delayed these major decisions, as they have had little choice. The Millennials seem to be more averse than prior generations to taking too large of a financial risk when better and easier opportunities are available. Who can blame them?

Millennials and Real Estate

Historical peak home buying years are 25-45. However, the percent of adults married and living in their own home has been on a steady decline – 56% in 1968, 43% in 1981 and 23% in 2012.

This phenomenon has contributed to a significant slowdown in most housing markets in single family home purchases but it has also contributed to a significant increase in multifamily and single family rental occupancy and rental rates. Additionally, many Millennials have retaken residency in their parents’ vacant bedroom or basement in order to be able to save up to make some of these major financial decisions, like a down payment on a home purchase. Thus far, multi family and single family investment rentals have been beneficiary for investors.

According to Trulia, 93% of 18 – 34 year olds reported they want to own a home in the future. One big question is will interest rates stay low long enough and economic conditions continue to improve to allow more people to enter the housing market or will there be one more reason to push the largest generation in history away from the American Dream. Given these trends, single family real estate investors need to remain nimble and have a good balance of rental product coupled with for sale product.

Corevest Finance has real estate loan products and terms to help investors stay nimble, says Jim Dow, SVP of Originations at Corevest Finance. Jim continued, “Our lines of credit are flexible enough to allow real estate investors the ability to quickly get in and get out of their assets and our term loans for rental portfolios allow investors to build equity via rent and market appreciation.

For more information about how CoreVest can help grow your rental and rehab business, please call 844.223.2231 or submit our contact form.

Disclaimer:

The views expressed herein are the opinions of CoreVest personnel. CoreVest makes no representation or warranty, express or implied, as to the accuracy or completeness of any of the information in this presentation. The views expressed may be based on market data or research provided by third-parties. CoreVest has not independently verified any of the information set forth in this presentation.

Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. CoreVest assumes no obligation to update or otherwise revise any of the information herein (even if such information is no longer accurate or complete or if experience or future changes make it clear that any projected results expressed or implied will not be realized).

Nothing contained in this presentation is, or should be relied upon as, a promise or representation as to the future performance of the real estate markets referred to herein. In all cases, readers should conduct their own independent investigation and analysis of the information contained in this presentation.