Last week, the CoreVest team attended and proudly sponsored the IMN Single Family Rental (East)…

Real Estate Investing? There are Apps for That.

By Dan Federico.

As the number of real estate investors continues to grow, so too has the number of real estate investment “app” platforms. This is to be expected as we live in an age where technology has entered nearly every facet of life, including a specialized niche such as real estate investing. In fact, numerous apps have popped up in recent years to address the different steps of the real estate investing process. Whether it’s finding investment properties, conducting financial analyses, seeking investment capital or simply expanding real estate knowledge, there is an app for that.

The real estate investment technology landscape, also known as “proptech,” is only set to grow in 2020 and beyond. Within the past two years alone, an estimated $5 billion dollars has been invested in real estate technology by venture capital firms. This seemingly once traditional and antiquated industry now sees a new wave of tech companies emerge to assist real estate investors with their day-to-day businesses.

Proptech firms are digging deeper, asking the right questions, and targeting problems and solutions that investors face. What are investors’ biggest needs? Is it locating their next investment property, determining the data points behind the investment, or trying to find like-minded investors to partner with or bounce ideas off? To help you navigate the wealth of apps and possibilities, we highlight 6 apps that standout below. These can be helpful tools for many different types of real estate investors.

Locating Properties

The first step in investing is locating the property and the data behind it. Zillow and House Canary are two platforms that have capitalized on the accessibility of information that is used in making real estate investment decisions.

Zillow

Zillow emerged in 2006 and has grown to a database that includes over 110 million U.S. homes, and over 188 million monthly users. Zillow provides investors with a platform that helps to locate properties—and a number of statistics to go with them. One can find property specifics relating to type, square footage, number of bedrooms and bathrooms, previous listing prices, and property taxes. All these pieces of information are key to determining whether that property is the right one for your business purpose.

One limiting factor of the Zillow platform is its focus on specific asset types, mainly SFR. For example, if an investor is looking for their next multifamily purchase, Zillow may not be the best app to find it. One can find rents and specs on an individual unit in a multifamily property, but finding more information at the property level will prove to be difficult.

Come Home

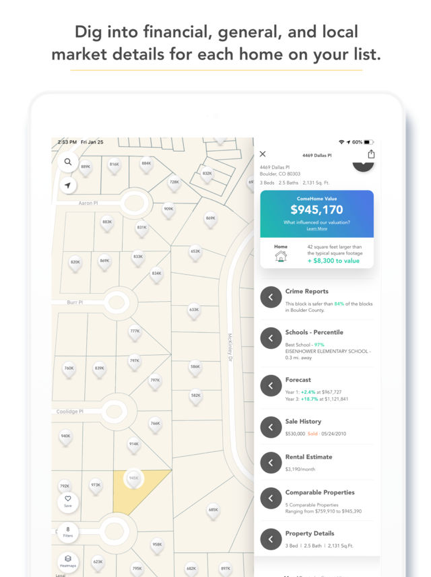

The data analytics firm, House Canary, invented the app Come Home in order to take a real estate search platform (like Zillow) one step further. The Come Home app does this by integrating the essential data that is needed for purchasing a property as an investment. Investors can access dozens of data points to customize their search. Investors can filter searches based on all the standard filters plus one year forecast estimates, rental estimates, rental yield, and risk of decline. Once investors locate a property, they can view crime reports, comparable properties, rental estimates, rental yield, forecast growth, and many other key details.

Users who are looking at certain geographic markets can filter results by schools, safety, growth areas, and stable areas. With these specific searches, Come Home’s technology looks for investment properties that are in areas with low crime and good schools, homes expected to appreciate over the next year, and homes with a low risk of losing value.

The app also includes a “heatmap” feature where investors can view crime, school, price, and forecast statistics of the properties relative to the market.

Investors can never have enough information when trying to locate their next investment property. Come Home provides a large amount of the data necessary for investors to decide whether to move forward with a property. If you look at it from the other side of the table (lending), the data points provided are ones that are taken into consideration by most lenders.

Buying Properties

When it comes to buying properties, apps such as Auction.com and RedFin complement the space with additional features, data intelligence, ease of use and wide reach.

Auction.com

Locating and buying discounted residential properties (foreclosures and bank-owned properties) is the specialty of Auction.com. It is the place where buyers and sellers can come together in an auction-type setting. This also means that, generally, the only listings they provide are bank-owned and foreclosure types of sales.

After being presented with valuable due diligence data, such as a property information report and title information, buyers can use the app to bid on properties. Although it is easy to bid and win an auction on an investment property from your phone, investors should do their own due diligence outside of the platform. For example, investors should inspect the bank owned or foreclosed property, as it may be hard to tell the true condition of the property from a photo on the app.

This platform is a great tool to get connected to bank-owned and foreclosure sales across the United States. Auction.com is home to over 4.4 million registered buyers and has sold over 329,000 properties to date. It lists properties in all 50 states and has registered an impressive $39 billion in sales.

If investors are interested in commercial rather than residential properties, Auction.com’s sister company (or division), Ten-X Commercial, has you covered. They provide an end-to-end transaction platform for all commercial real estate properties, and is utilized by brokers, buyers and sellers. Over $20 billion in commercial assets have been sold using this platform which consists of a network of over “400,000 qualified buyers in 75 countries.” The platform provides access to consolidated due diligence documents to evaluate possible investment opportunities and even projects financial data for the properties (revenue, expenses, NOI).

When trying to sell a property using Ten-X, they use a proprietary algorithm that matches buyers to your listing based on patterns and portfolio holdings. The app takes you from start to finish in the transaction process—all the way from listing the property, to handling contracts and closing.

RedFin

RedFin is another great option when it comes to buying and selling properties. With this tool, you can buy and sell properties directly through the app. They pride themselves on keeping selling costs low with a listing fee as low as 1%, as well as cutting down closing costs for potential buyers. Through their service, RedFin has over 80,000 customers to date with $47 billion in home sales and have helped customers save a total of $400 million.

Users can access the latest data on sale prices of nearby homes. RedFin stands by the claim that since they have complete access to multiple listing services, they can get listings that other sites do not. Once your offer has been accepted, RedFin provides a timeline for users to track documents, tasks and deadlines. Keeping buyers “in the know” throughout each step helps speed up the closing process for investors.

Property / Investment Analysis

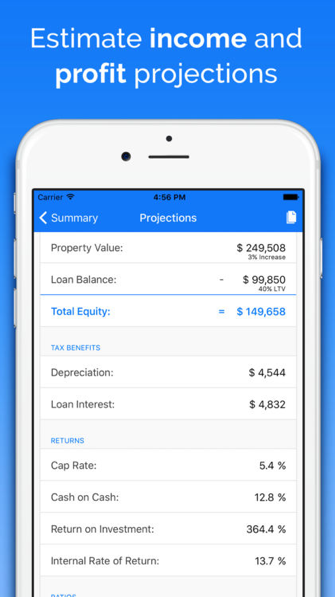

Perhaps the most important step in the investment process is the analyzing of properties to ensure that the return is worth the investment. Several apps are used by real estate investors to crunch numbers on properties.

DealCheck

With apps like DealCheck, investors can analyze the returns and costs on the properties they are interested in, as well as what they should pay for it. By analyzing the property and the surrounding market in question, investors are able to make more sophisticated decisions. Investment analysis apps allow investors to calculate cap rate, cash on cash return, return on investment, and the debt coverage ratio on the property.

DealCheck serves not only fix and flip investors, but also those looking to buy and hold. It also supports all residential and commercial properties. DealCheck collects data straight from the MLS to provide investors with property description, property photos, list prices, and rent estimates. A useful feature in the app is the “deal calculator.” This feature helps you to structure your desired deal using inputs such as purchase price, financing, closing costs, rehab budget, rent roll and expenses. For homeowners that are looking to utilize their home as a rental, DealCheck can help investors determine how much passive income a property could generate.

DealCheck has been used by over 75,000 investors worldwide, with over 200,000 rental properties analyzed, and over 170,000 flips analyzed.

Real Estate Investor Community / Educating Yourself

A never-ending requirement of investing in real estate is to remain educated. People learn in a multitude of methods, and there are tools out there to satisfy each individual’s preference.

Bigger Pockets

One of, if not, the biggest platform for educating yourself in real estate, is BiggerPockets. BiggerPockets is the ideal tool for investors that do not wish to spend thousands of dollars on real estate courses and conferences. This platform allows newer investors, and those wishing to enter the space, to educate themselves by networking and learning from more experienced investors.

This platform can be described as the Facebook or LinkedIn of the real estate community. It has several educational tools that are utilized by over 1 million real estate investors — those with SFR and/or multifamily properties. Investors can read blogs and articles about a wide range of real estate topics.

Those looking to network can take to the forums to converse with other real estate investors or message them directly to ask questions, look for partners, or receive advice on deal analysis. Investors who are looking to further their analytical skills can use Bigger Pocket’s calculators to analyze rental properties, fix and flip opportunities and potential mortgage payments.

Conclusion

It would be remiss to say that apps are the only tools needed for investment success. While they are helpful for investors at different stages in the real estate investment process, it is still necessary to perform extensive due diligence and evaluate each aspect of the investment strategy. A business as lucrative (and costly) as real estate investing cannot always be as easy as a few clicks of a button.

Nevertheless, the increasing interest in the purchase of investment properties coupled with an influx of technology in the space, has created a quicker start-to-finish investment lifecycle. While the utilization of apps might not be for everyone, it can be a great resource for real estate investors who choose to leverage the technology. These tech-savvy investors are constantly seeking new tools to quickly size and seize opportunities as competition increases within the space.

For them, apps do just that, by providing critical insight at the touch of the fingertips. Whether they are searching for properties, analyzing them, or trying to close their next investment property loan, there’s an app for that. And, speed and efficiency can be the difference maker.

CoreVest provides attractive long-term debt products for stabilized rental portfolios as well as credit lines for new acquisitions. For more information about how CoreVest can help you grow your rehab or rental business, please call Dan Federico at 949.523.2898 or email [email protected].

#IG